Not known Incorrect Statements About Financial Advisor Certifications

Wiki Article

The smart Trick of Financial Advisor That Nobody is Discussing

Table of ContentsFinancial Advisor Certifications Things To Know Before You BuyTop Guidelines Of Financial Advisor LicenseThe 25-Second Trick For Financial Advisor FeesEverything about Financial Advisor SalaryThe Definitive Guide to Financial Advisor Certifications

You should also take into consideration just how much money you have. If you're seeking an advisor to handle your money or to aid you spend, you will certainly need to satisfy the consultant's minimum account needs. Minimums vary from advisor to advisor. Some may function with you if you have just a few thousand dollars or much less.

You'll after that have the capacity to interview your suits to discover the ideal fit for you.

The Main Principles Of Financial Advisor Magazine

Before meeting with a consultant, it's an excellent suggestion to believe concerning what kind of consultant you require. Start by considering your financial scenario as well as goals. Advisors in some cases specialize to become experts in a couple of facets of individual money, such as taxes or estate preparation. So if you're searching for specific suggestions or services, consider what sort of economic consultant is a specialist because location.

Which one should you collaborate with? We useful link locate that, mostly, people seeking economic recommendations recognize to look for a financial advisor who has high degrees of honesty as well as that wishes to do what is in their clients' best interest at all times. It appears that fewer individuals pay attention to the positioning of their financial consultant candidates.

Financial Advisor - Questions

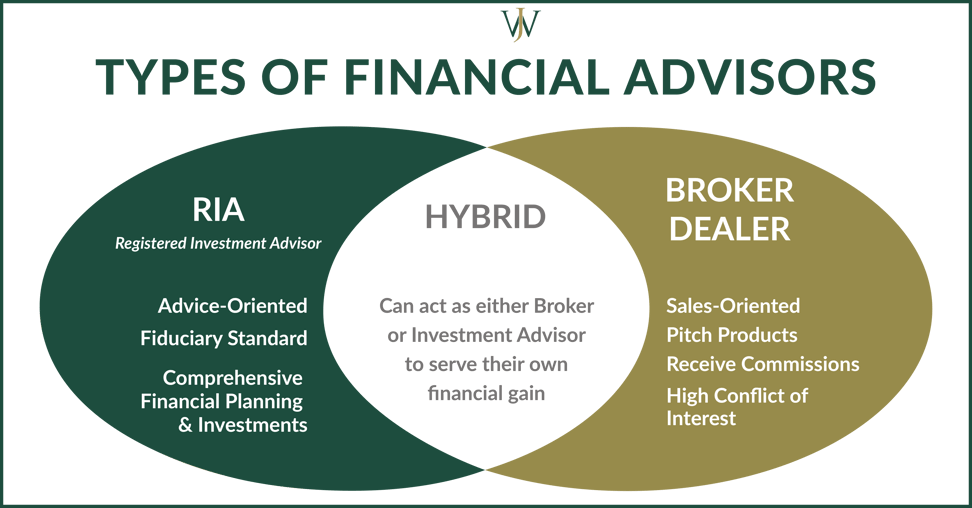

Here's a check out 4 various kinds of experts you are most likely to run into and how they pile up against each other in some key locations. Armed with this information, you must be able to much better evaluate which type is ideal suited for you based on aspects such as your objectives, the complexity of your monetary scenario and also your total assets.Investment consultant. Investment advisors are excellent economic specialists who do a very excellent task managing moneybut that's all they do. While investment consultants supply a solitary solutionmoney managementthat one option can have numerous variants (from safeties to financial investments in private companies, actual estate, art work and also so forth).

, one should first obtain the needed education by taking monetary consultant programs. Financial advisors must have at the very least a bachelor's level, as well as in some instances a master's is suggested.

The Only Guide to Financial Advisor Ratings

Financial consultants will need this structure when they are suggesting clients on minimizing their risks as well as saving money. One more area of study concentrates why not check here on financial investment preparation. In this program, pupils discover how the securities market works together with various other investment methods. When functioning as an economic consultant, understanding of financial investment preparation might confirm essential when trying to create investment strategies for customers., such as changing a front lights or an air filter, but take the automobile to a mechanic for large tasks. When it comes to your financial resources, however, it can be trickier to figure out which jobs are Do it yourself (financial advisor ratings).

There are all kinds of financial pros around, with dozens of different titles accounting professionals, financiers, cash supervisors. It's not constantly clear what they do, or what sort of troubles they're equipped to deal with. If you're really feeling out of your deepness monetarily, your very first step ought to be to discover who all these different financial professionals are what they do, what they bill, and what choices there are to hiring them.

Financial Advisor Certifications Things To Know Before You Buy

1., an accountant can do various other jobs for you.

Your accountant can also prepare financial declarations or reports. Exactly How Much They Expense According to the National Culture of Accountants, the ordinary cost to have an accounting professional submit your tax obligations ranges from $159 for a straightforward return to $447 for one that includes service revenue. If you wish to employ an accountant for your company, the cost you pay will depend on the size of Look At This the company you're managing as well as the accountant's degree of experience.

Report this wiki page